Yes, Cigna Insurance offers coverage for teen mental health treatment in California. Cigna’s behavioral health services are designed for a range of needs, including inpatient, outpatient, and intensive teen treatment programs. Under the 2024 Mental Health Parity and Addiction Equity Act (MHPAEA), mental health and substance abuse treatments are given the same level of coverage as physical health conditions. This makes quality care available to teens and their families in CA.

At Key Healthcare, we accept Cigna insurance for our various proven programs for teens. These include live-in treatment, partial day treatment (PHP), and intensive outpatient programs (IOP). In our California facilities, a safe and supportive setting is provided where teens receive full care for substance use and mental health issues like anxiety, depression, and trauma that occur at the same time.

Understanding insurance coverage can feel difficult, but we are here to help. Contact our Admissions Director today or complete our simple insurance check form to learn how Cigna can help cover your teen’s treatment. Let us guide you through the process to make sure your teen receives the care they deserve.

Does Cigna Insurance Cover Adolescent Mental Health Treatment at Key Healthcare?

Yes, we accept various private insurance plans, including Cigna. However, we must verify your insurance details with Cigna to confirm your specific coverage. This step helps us understand your plan’s benefits and ensures that you are fully informed about what’s covered in your teen’s mental health treatment.

Once your insurance is checked, our team provides a detailed treatment plan made for your teen’s needs. Any out-of-pocket costs will also be explained, if they apply, so there are no surprises. Contact us today or complete our insurance check form to get started—we’re here to guide you at every step.

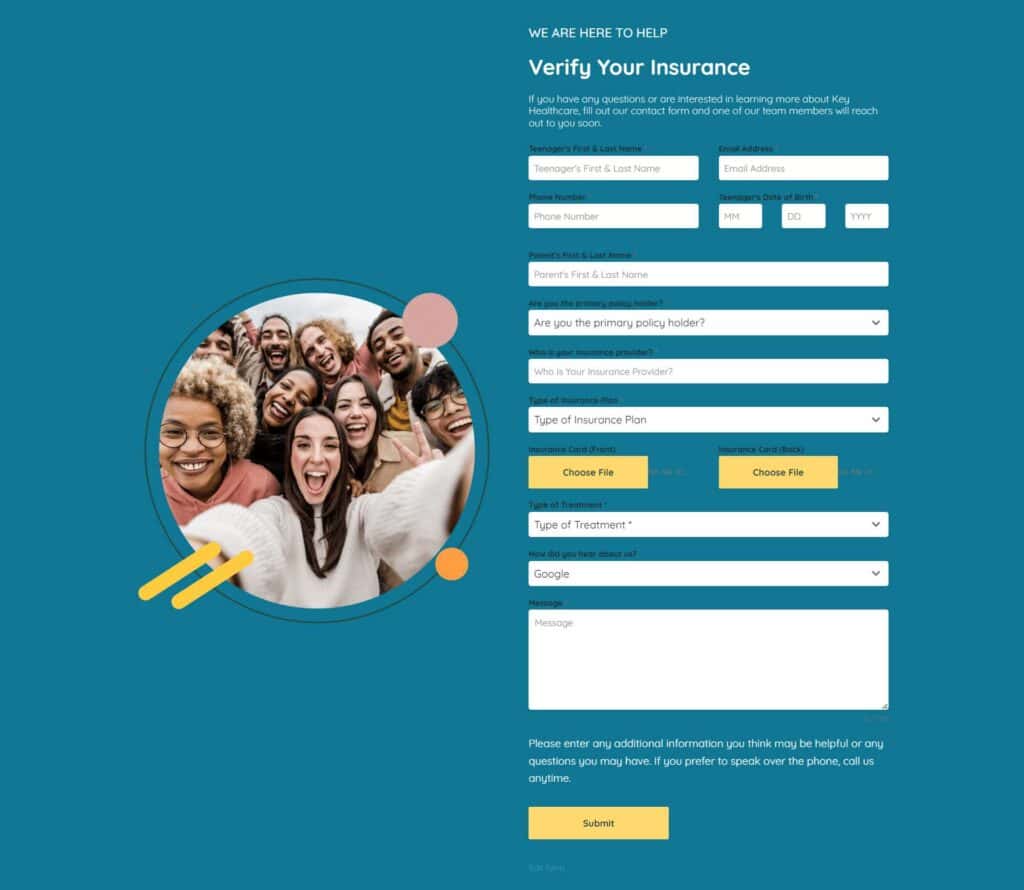

How to Fill Out Key Healthcare’s Insurance Verification Form: Step-by-Step Guide

Step 1: Teenager’s First & Last Name: Provide the full name of your teen seeking treatment. This helps us correctly match your insurance details to your teen’s treatment plan.

Step 2: Email Address: Enter the email address where you want to get updates. We will use this email to give you updates on your insurance check and the next steps.

Step 3: Phone Number: Provide the best phone number to reach you. If we need more information, we will call you directly to talk about your coverage and any other details.

Step 4: Teenager’s Date of Birth: Enter your teen’s birthdate in the MM/DD/YYYY format. Your insurance company needs your teen’s date of birth to check eligibility and coverage for the treatment.

Step 5: Parents’ First & Last Name: Enter your full name as the parent or legal guardian. This helps us identify you as the contact for insurance matters and follow-up messages.

Step 6: Are You the Primary Policy Holder? Choose “Yes” if you are the main insurance policyholder or “No” if someone else (like a spouse or employer) holds the policy. This helps us know who to talk with for the insurance check.

Step 7: Who Is Your Insurance Provider? Enter the name of your insurance provider (e.g., Cigna, Aetna, Blue Cross Blue Shield). This lets us contact your provider to check your coverage and benefits.

Besides Cigna, we work with other insurance providers:

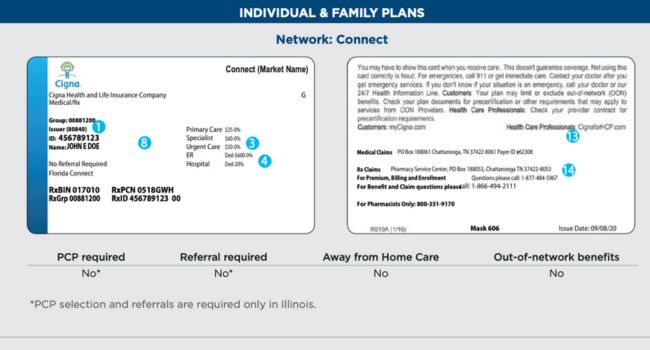

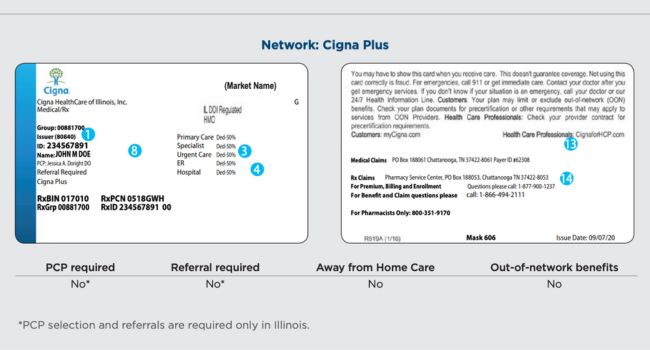

Step 8: Type of Cigna Insurance Plan: Enter the type of insurance plan you have (e.g., HMO, PPO, EPO, POS). This can be found on your insurance card or in your plan papers. Since plan types offer different coverage levels, this detail helps us see how your benefits apply to treatment.

- HMO: Best for families who want lower costs and are willing to use in-network providers for substance abuse and mental health treatment.

- PPO: This plan offers the most freedom in choosing providers, including out-of-network care. This is useful if your preferred treatment center is not in-network.

- EPO: This plan offers flexibility since referrals are not needed, but you must use in-network providers. It is a good choice for those who want simplicity.

- POS combines freedom of choice with lower in-network costs but requires PCP management. It is ideal for those comfortable with planning care through a primary doctor.

Key Differences at a Glance

| Feature | HMO | PPO | EPO | POS |

|---|---|---|---|---|

| In-Network Care | Required | Encouraged (lower cost) | Required | Required (lower cost) |

| Out-of-Network Care | Not Covered (except emergencies) | Covered (higher cost) | Not Covered (except emergencies) | Covered (higher cost) |

| Primary Care Physician | Required | Not Required | Not Required | Required |

| Specialist Referral | Required | Not Required | Not Required | Required |

| Premium Costs | Low | High | Medium | Medium |

| Out-of-Pocket Costs | Low (in-network) | Medium/High (in and out-of-network) | Low (in-network) | Medium (depends on network use) |

Step 9: Upload Insurance Card (Front): Upload a clear photo or scan of the front of your insurance card. This side of the card has your policy number, group number, and key contact information for your insurance provider.

Step 10: Upload Insurance Card (Back): Next, upload a clear image of the back of your insurance card. The back often has important details like customer service numbers and directions for healthcare providers.

Step 11: Type of Treatment: Show the type of treatment your teen needs in California (e.g., live-in treatment, substance abuse counseling, mental health therapy). This helps us check if your plan covers the specific care your teen requires.

Step 12: How Did You Hear About Us? Select how you learned about Key Healthcare (e.g., Google search, a friend’s referral, social media). This information helps us understand how families find our services.

Step 13: Message (Optional): If you have specific questions or details to add, please type them here. You can also note if you would rather talk on the phone, and we will call you. This space allows you to share any concerns or information that will help us better assist you.

Step 14: Submit: After you fill in all the fields, review your information and click Submit. When the form is submitted, our team can start the insurance check process. We will check your benefits and give you a clear explanation of your coverage.

B: Extra Tip: Where to Find Insurance Information

If you are not sure about your insurance details, you can check:

- Your insurance card for the policy number, plan type, and group number.

- Your insurance provider’s website to log in to your account for plan details.

- Your employer’s HR department if your insurance is provided through work.

C: What Happens After You Submit the Insurance Verification Form?

After we receive your form, our team will:

- Check your insurance: We will contact your insurance provider to confirm your benefits for teen substance abuse and mental health treatment.

- Give a breakdown: We will contact you with a full list of what is covered, including any out-of-pocket costs like co-pays or deductibles you may have.

- Follow up: We will schedule a call to go over everything if you have more questions or concerns.

By following these simple steps, you can make sure your teen’s treatment at Key Healthcare is covered. You will also be fully prepared for what comes next. If you need help with the form or want to speak with someone, please call us anytime. We are here to guide you through this process!

Coordination with California Cigna Insurance for Claims Processing

At Key Healthcare, we know the insurance claim process for dependents can be complex. We are here to guide you through each step of filing a claim under your Cigna plan for substance abuse treatment.

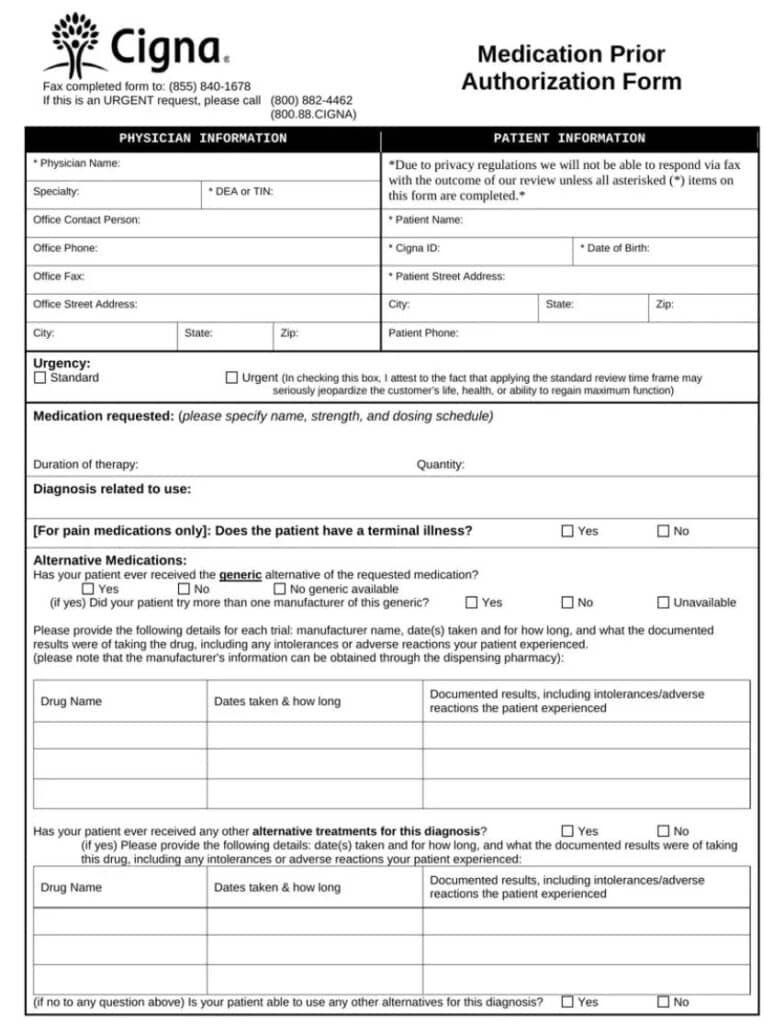

1. Pre-Authorization or Pre-Certification

Many Cigna plans require preapproval before certain treatments begin, especially live-in or inpatient care.

- How Key Healthcare Helps: We manage the full preapproval process for you. Our team sends the needed medical papers, including your child’s diagnosis, suggested treatment plan, and length of care, straight to Cigna.

- Why It Matters: Preapproval is secured by us in advance to avoid any gaps in coverage or delays in treatment.

2. Referral Requirement for HMO Plans

If you have an HMO plan, a referral from your Primary Care Physician (PCP) may be needed before your child can see a specialist or enroll in a substance abuse program.

- How Key Healthcare Helps: We can help you by working with your PCP to get the required referral. We also make sure your child is sent to a fitting provider in Cigna’s network.

- Why It Matters: This makes sure that your child’s treatment is fully covered by your plan, which reduces out-of-pocket costs.

3. Insurance Claim Submission

As a healthcare provider in California, Key Healthcare helps you submit claims to Cigna. This is usually done online, which saves you from handling the paperwork.

- Out-of-Network Providers: We will guide you on how to file your own claim if an out-of-network provider is used. This includes:

- Filling out the Cigna claim form.

- Sending in itemized bills, medical records, and proof of payment for any upfront costs.

- How Key Healthcare Helps: We make sure all needed information is sent in correctly, whether in-network or out-of-network. This helps prevent delays in claim processing.

4. Providing Necessary Documentation

- What You’ll Need:

- Insurance card details (policy number, group number).

- Your child’s details (full name, date of birth, and relation to the policyholder).

- Medical papers or diagnosis codes (provided by Key Healthcare).

- Itemized bills (EOB) that detail services and their costs.

- How Key Healthcare Helps: We give you all the medical papers and itemized bills needed to make sure your claim is submitted correctly. We also help you organize and keep copies of all paperwork.

5. Paying Out-of-Pocket Costs

You may be responsible for deductibles, co-pays, or coinsurance, depending on your California Cigna plan. We help you understand these cost-sharing rules.

- How Key Healthcare Helps: We offer flexible payment plans to make payments easier if there are any out-of-pocket costs.

- Why It Matters: A smoother treatment process without surprise costs is ensured by understanding and managing your financial duties.

6. Appealing Denied Claims

If a claim is denied by Cigna, the decision can be appealed. Appeals may include:

- Asking for a review with more medical papers or proof that it is medically needed.

- Asking for a peer-to-peer review, where our provider can talk about the claim directly with a Cigna medical reviewer.

- How Key Healthcare Helps: We help prepare and send all the needed papers for the appeal. Our skilled team makes sure appeals are filed on time and presents the best case possible to Cigna.

- Why It Matters: We work to reverse denied claims so that care is covered if your child needs to continue treatment.

7. Coordination of Benefits (COB)

If your child is covered by more than one insurance plan in California, you may need to coordinate benefits. Cigna will decide which insurance company is the main payer.

- How Key Healthcare Helps: We help give Cigna the needed information to make sure benefits are coordinated the right way. We can also help manage sending claims to both insurance companies if needed.

- Why It Matters: Good coordination makes sure all benefits are used well, which lowers your out-of-pocket costs.

8. Completing Dependent Coverage Verification

Some Cigna plans require a yearly check to confirm your child is still an eligible dependent (e.g., they are under a certain age or a full-time student).

- How Key Healthcare Helps: If Cigna needs a dependent check, we help by reminding you of deadlines and helping you fill out and send in the needed forms.

- Why It Matters: Finishing the dependent check on time ensures your child’s treatment coverage continues without a break.

Contact us today to learn how we can help you get the most from your Cigna insurance benefits.

Cigna Insurance Coverage for Substance Abuse and Mental Health in California

Cigna provides wide coverage for behavioral health services, which includes substance abuse treatment and care for mental health conditions that occur at the same time in California. Our programs are made to meet Cigna’s treatment standards, so we offer a full range of services that match what your plan covers:

1. Initial Evaluation and Diagnosis

- A full review of substance use, physical and mental health, and social factors is done.

- The teen’s substance use disorder is diagnosed to decide on the right treatment plan.

2. Inpatient Treatment

- Inpatient Detox: This covers medically watched detox in a hospital or treatment center for teens with serious substance dependence (e.g., alcohol, opioids). Detox is needed to safely manage withdrawal symptoms.

- Inpatient Residential Treatment: This includes 24-hour care in a licensed teen residential treatment center for more serious cases, particularly when outpatient care has not worked.

3. Outpatient Treatment

- Outpatient Therapy: This includes regular therapy sessions with a licensed counselor, psychologist, or psychiatrist. Individual, group, and family therapy are offered.

- Adolescent Intensive Outpatient Program (IOP): This program is more structured than regular outpatient therapy. It usually involves several therapy sessions each week and focuses on recovery while the teen lives at home.

- Adolescent Partial Hospitalization Program (PHP): This program offers a high level of care without an overnight stay. Teens get treatment during the day and go home in the evening.

4. Medication-Assisted Treatment (MAT)

- This covers medicines used to help manage withdrawal symptoms or prevent a relapse. It includes drugs like buprenorphine, naltrexone, and methadone for opioid addiction, and disulfiram or acamprosate for alcohol dependence.

5. Counseling and Therapy

- Teen Cognitive Behavioral Therapy (CBT) and Teen Dialectical Behavioral Therapy (DBT) are often used to treat both substance abuse and mental health issues that happen together (dual diagnosis).

- Teen Family therapy is often included because Cigna knows that involving the family in recovery is important.

6. Dual Diagnosis Treatment

Cigna covers treatment for teen disorders that happen together. This includes a teen dual diagnosis approach for substance abuse and mental health issues, such as depression or anxiety.

7. Telemedicine for Substance Abuse

- Some plans cover remote sessions, which allow teens to receive counseling or therapy through video or phone calls.

8. Preventive Services

- Screening and counseling services are available to help prevent or lower the use of alcohol or other controlled substances. This includes planned assessments and risk reduction support.

9. Aftercare and Relapse Prevention

- Coverage may include teen aftercare programs and support. Examples are ongoing therapy, outpatient counseling, and support groups to help maintain sobriety after treatment.

10. Family Involvement

Cigna often covers family therapy sessions, as it knows the important role family members play in the recovery process for teens with substance abuse issues.

11. Coverage for Relapse

If your teen relapses, Cigna typically continues to cover treatment because relapse is seen as part of the recovery process. This may include starting outpatient therapy or inpatient treatment again.

Out-of-Pocket Cost Transparency

We know that cost is a major concern for parents. For this reason, we make sure you are fully aware of any out-of-pocket costs you might have, like deductibles, co-pays, and coinsurance. After your Cigna coverage is checked, a clear breakdown of what is covered will be provided to you. This includes anything that will come out of pocket. With Key Healthcare and Cigna, you can be sure there will be no hidden fees or surprises.

Answering All Your Questions About California Cigna Coverage

At Key Healthcare, our goal is to make sure every parent in California feels fully informed and supported. If you have questions about specific coverage details, here is a quick look at some common questions: Does Cigna cover detox and withdrawal management in California?

Does Cigna cover detox and withdrawal management in California?

Yes, Cigna covers detox services when they are found to be medically necessary.

Are dual diagnosis treatments covered?

Yes, Cigna in California covers treatment for both substance abuse and mental health conditions that happen together, such as anxiety or depression.

Will my teen’s treatment be covered if they relapse?

Yes, relapse is seen as part of the recovery process. More treatment is often covered, but it may require preapproval.

What if Cigna Insurance denies coverage for treatment?

If treatment is denied at first, we will work with you to appeal the decision. We will also provide more medical papers to support the need for more care.

Key Healthcare Mental Health Treatment for Teens with Cigna Coverage

Cigna covers treatment for a wide range of mental health disorders, including:

- Teen Anxiety and Teen Depression

- Adolescent Bipolar Disorder

- Teen PTSD (Post-Traumatic Stress Disorder)

- Teen ADHD (Attention-Deficit/Hyperactivity Disorder)

- Teen Eating Disorders

- Oppositional Defiant Disorder (ODD)

- Teen Obsessive-Compulsive Disorder (OCD)

Whether your teen is struggling with anxiety, depression, ADHD, bipolar disorder, or other behavioral health issues, Cigna’s behavioral health benefits include:

- Psychiatric evaluations and diagnoses

- Individual and family counseling

- Teen Cognitive Behavioral Therapy (CBT)

- Managing medications for mental health disorders

- Inpatient mental health services for teens who need close care and monitoring

Trust Key Healthcare to Help You Navigate Cigna Coverage in California

Most Cigna plans require preapproval for live-in treatment programs in California, which means the treatment must be found to be medically necessary. At Key Healthcare, we manage the entire preapproval process for you. We make sure all medical papers and reviews are submitted correctly. This is key to getting fast approval from Cigna, so your teen can start treatment without delay.

You can start today by filling out our insurance check form. Let us help you get the care your teen needs with support from Cigna. If you have more questions, please contact us. We are here to help you at every step.